Property Tax Rate In Waterbury Ct . city of waterbury 2022 revaluation estimated tax projections. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. 1st half due july 1st each year, 2nd half due january 1 each year. No bill will be sent for 2nd installment. the information on this web site is believed to be an accurate, complete and a fair representation of the records of the. the assessor's office is responsible for ensuring that all property identified in the connecticut general statutes as being. Compare your rate to the connecticut and u.s.

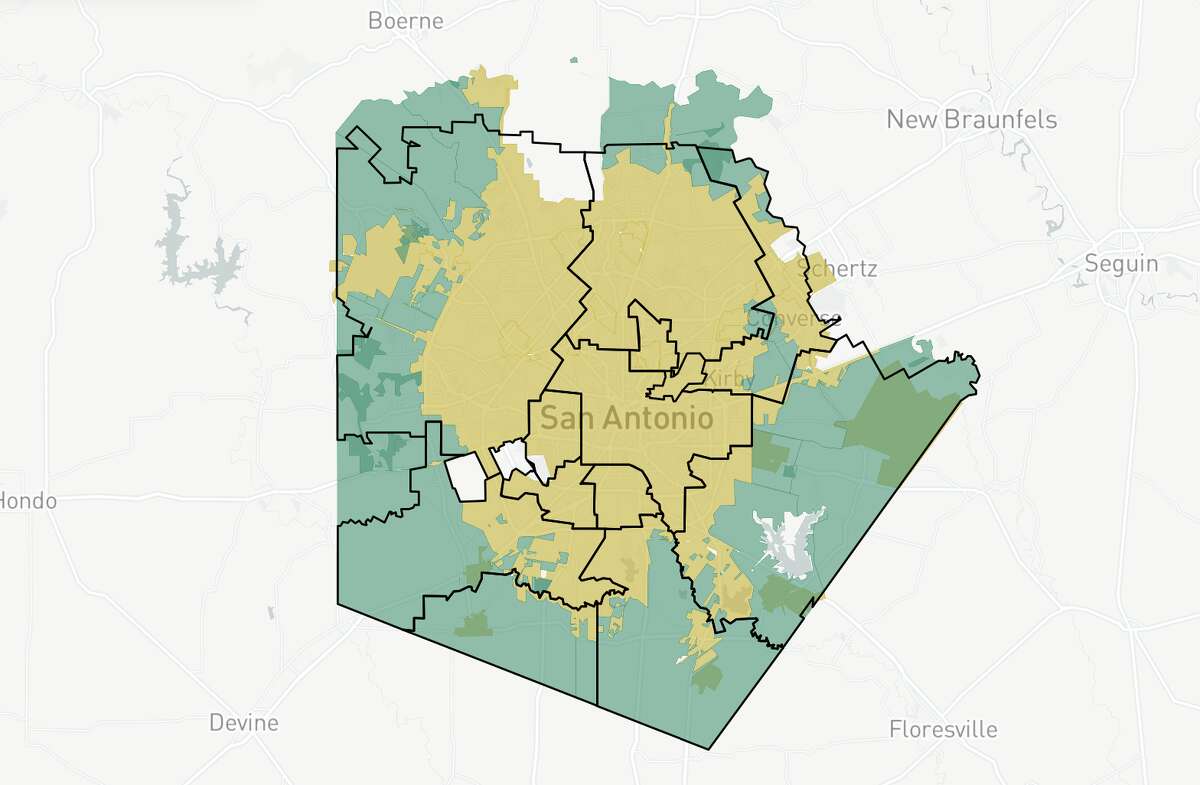

from www.expressnews.com

No bill will be sent for 2nd installment. 1st half due july 1st each year, 2nd half due january 1 each year. the assessor's office is responsible for ensuring that all property identified in the connecticut general statutes as being. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. city of waterbury 2022 revaluation estimated tax projections. the information on this web site is believed to be an accurate, complete and a fair representation of the records of the. Compare your rate to the connecticut and u.s.

Map Keep current on Bexar County property tax rate increases

Property Tax Rate In Waterbury Ct the assessor's office is responsible for ensuring that all property identified in the connecticut general statutes as being. the assessor's office is responsible for ensuring that all property identified in the connecticut general statutes as being. city of waterbury 2022 revaluation estimated tax projections. 1st half due july 1st each year, 2nd half due january 1 each year. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the information on this web site is believed to be an accurate, complete and a fair representation of the records of the. No bill will be sent for 2nd installment. Compare your rate to the connecticut and u.s.

From wallethub.com

Property Taxes by State Property Tax Rate In Waterbury Ct 1st half due july 1st each year, 2nd half due january 1 each year. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. No bill will be sent for 2nd installment. the information on this web site is believed to be an accurate, complete and a fair representation of. Property Tax Rate In Waterbury Ct.

From realestateinvestingtoday.com

How Much Are You Paying in Property Taxes? Real Estate Investing Today Property Tax Rate In Waterbury Ct the assessor's office is responsible for ensuring that all property identified in the connecticut general statutes as being. 1st half due july 1st each year, 2nd half due january 1 each year. Compare your rate to the connecticut and u.s. calculate how much you'll pay in property taxes on your home, given your location and assessed home value.. Property Tax Rate In Waterbury Ct.

From showcasect.com

Waterbury Property Revaluation & Tax Adjustments Showcase Realty Inc. Property Tax Rate In Waterbury Ct No bill will be sent for 2nd installment. the information on this web site is believed to be an accurate, complete and a fair representation of the records of the. the assessor's office is responsible for ensuring that all property identified in the connecticut general statutes as being. 1st half due july 1st each year, 2nd half due. Property Tax Rate In Waterbury Ct.

From www.financialsamurai.com

Historical Estate Tax Exemption Amounts And Tax Rates Property Tax Rate In Waterbury Ct the information on this web site is believed to be an accurate, complete and a fair representation of the records of the. 1st half due july 1st each year, 2nd half due january 1 each year. Compare your rate to the connecticut and u.s. city of waterbury 2022 revaluation estimated tax projections. calculate how much you'll pay. Property Tax Rate In Waterbury Ct.

From crimegrade.org

Waterbury, CT Property Crime Rates and NonViolent Crime Maps Property Tax Rate In Waterbury Ct No bill will be sent for 2nd installment. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the information on this web site is believed to be an accurate, complete and a fair representation of the records of the. 1st half due july 1st each year, 2nd half due. Property Tax Rate In Waterbury Ct.

From www.thewaterbury.com

City Safety & Job Facts For Waterbury, CT The Waterbury Property Tax Rate In Waterbury Ct calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Compare your rate to the connecticut and u.s. the assessor's office is responsible for ensuring that all property identified in the connecticut general statutes as being. city of waterbury 2022 revaluation estimated tax projections. the information on this. Property Tax Rate In Waterbury Ct.

From taxfoundation.org

What Connecticut Can Learn from its Neighbors Property Tax Limitations Property Tax Rate In Waterbury Ct calculate how much you'll pay in property taxes on your home, given your location and assessed home value. 1st half due july 1st each year, 2nd half due january 1 each year. city of waterbury 2022 revaluation estimated tax projections. Compare your rate to the connecticut and u.s. the information on this web site is believed to. Property Tax Rate In Waterbury Ct.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation Property Tax Rate In Waterbury Ct the assessor's office is responsible for ensuring that all property identified in the connecticut general statutes as being. city of waterbury 2022 revaluation estimated tax projections. the information on this web site is believed to be an accurate, complete and a fair representation of the records of the. 1st half due july 1st each year, 2nd half. Property Tax Rate In Waterbury Ct.

From darienite.com

Study Connecticut Has the Fourth Highest Property Taxes in the Country Property Tax Rate In Waterbury Ct the assessor's office is responsible for ensuring that all property identified in the connecticut general statutes as being. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. No bill will be sent for 2nd installment. the information on this web site is believed to be an accurate, complete. Property Tax Rate In Waterbury Ct.

From stephenhaw.com

Rates of Property Taxes in California's The Stephen Haw Group Property Tax Rate In Waterbury Ct No bill will be sent for 2nd installment. city of waterbury 2022 revaluation estimated tax projections. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the information on this web site is believed to be an accurate, complete and a fair representation of the records of the. Compare. Property Tax Rate In Waterbury Ct.

From realestatestore.me

2018 Property Taxes The Real Estate Store Property Tax Rate In Waterbury Ct 1st half due july 1st each year, 2nd half due january 1 each year. No bill will be sent for 2nd installment. the assessor's office is responsible for ensuring that all property identified in the connecticut general statutes as being. calculate how much you'll pay in property taxes on your home, given your location and assessed home value.. Property Tax Rate In Waterbury Ct.

From activerain.com

July 2023 Real Estate Sales Report for Waterbury CT Property Tax Rate In Waterbury Ct the information on this web site is believed to be an accurate, complete and a fair representation of the records of the. Compare your rate to the connecticut and u.s. No bill will be sent for 2nd installment. the assessor's office is responsible for ensuring that all property identified in the connecticut general statutes as being. 1st half. Property Tax Rate In Waterbury Ct.

From finance.georgetown.org

Property Taxes Finance Department Property Tax Rate In Waterbury Ct calculate how much you'll pay in property taxes on your home, given your location and assessed home value. 1st half due july 1st each year, 2nd half due january 1 each year. No bill will be sent for 2nd installment. the assessor's office is responsible for ensuring that all property identified in the connecticut general statutes as being.. Property Tax Rate In Waterbury Ct.

From patch.com

Connecticut Property Taxes In Every Town Who Pays The Most Property Tax Rate In Waterbury Ct city of waterbury 2022 revaluation estimated tax projections. 1st half due july 1st each year, 2nd half due january 1 each year. No bill will be sent for 2nd installment. the assessor's office is responsible for ensuring that all property identified in the connecticut general statutes as being. Compare your rate to the connecticut and u.s. the. Property Tax Rate In Waterbury Ct.

From taxfoundation.org

State Estate Tax Rates & State Inheritance Tax Rates Tax Foundation Property Tax Rate In Waterbury Ct Compare your rate to the connecticut and u.s. No bill will be sent for 2nd installment. 1st half due july 1st each year, 2nd half due january 1 each year. city of waterbury 2022 revaluation estimated tax projections. the assessor's office is responsible for ensuring that all property identified in the connecticut general statutes as being. the. Property Tax Rate In Waterbury Ct.

From navyollie.blogspot.com

waterbury ct taxes owed Agustina Herrington Property Tax Rate In Waterbury Ct No bill will be sent for 2nd installment. Compare your rate to the connecticut and u.s. city of waterbury 2022 revaluation estimated tax projections. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the information on this web site is believed to be an accurate, complete and a. Property Tax Rate In Waterbury Ct.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation Property Tax Rate In Waterbury Ct the assessor's office is responsible for ensuring that all property identified in the connecticut general statutes as being. the information on this web site is believed to be an accurate, complete and a fair representation of the records of the. Compare your rate to the connecticut and u.s. 1st half due july 1st each year, 2nd half due. Property Tax Rate In Waterbury Ct.

From dxouohord.blob.core.windows.net

Ellington Ct Property Taxes at Jonathan Martinez blog Property Tax Rate In Waterbury Ct city of waterbury 2022 revaluation estimated tax projections. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. 1st half due july 1st each year, 2nd half due january 1 each year. the information on this web site is believed to be an accurate, complete and a fair representation. Property Tax Rate In Waterbury Ct.